September Housing

More than a place, VOCE is an all-encompassing way of living: an unprecedented offering that redefines living, owning, traveling, and working, powered by hospitality.

VOCE features meticulously designed and graciously scaled residences, a boutique hotel, inspiring workspaces, and a peerless collection of amenities and services. VOCE stands alone as the only development in Nashville that allows owners to participate in a hotel hospitality program, which provides owners with valuable investment opportunities.

Situated along the city’s bustling West End Corridor, VOCE promises an experience beyond compare in the South’s thriving center of culture, creativity, and commerce.

VOCE residences offer spacious studio, one-, two-, and three-bedroom floor plans, plus seven penthouse units. Each reveals an understated yet distinct aesthetic, and a true commitment to quality in every detail.

Features include:

The Hotel Program:

Source: Voce Hotel & Residences

Metro has selected The Fallon Company to serve as master developer of the East Bank — with the Boston-based commercial real estate company proposing retail, residential and hotel buildings projected to be valued at about $1 billion in Phase I of the effort.

Source: Nashville Post

| The Metro Nashville Council recently approved settlements with several Nashville builders who had previously taken legal action against the city regarding an ordinance requiring them to build a sidewalk or pay into a sidewalk fund for the city. That same ordinance was then struck down by the courts earlier this summer. Certain property owners and home developers may now be eligible for a refund of those funds that they were required to pay within the past 15 months. Metro’s official website now includes a form for property owners to submit a claim for the cost of sidewalk construction or the fee they paid in lieu. Residents must meet certain qualifications for their claims to be considered, so not all individuals who complied with the ordinance since its enactment in 2017 will be eligible for reimbursement. According to Metro’s website, to be eligible for a claim, the expenses incurred for ordinance compliance must have been accrued on or after May 10, 2022, one year prior to the 6th U.S. Circuit Court of Appeals’ ruling. For those interested in seeking a refund, more details on filing a claim and determining if you are eligible for this refund can be found here. |

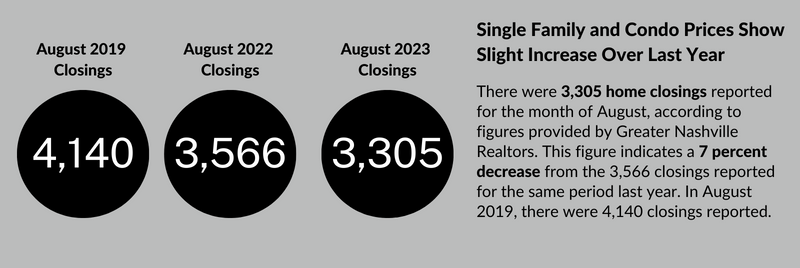

Source: Greater Nashville Realtors

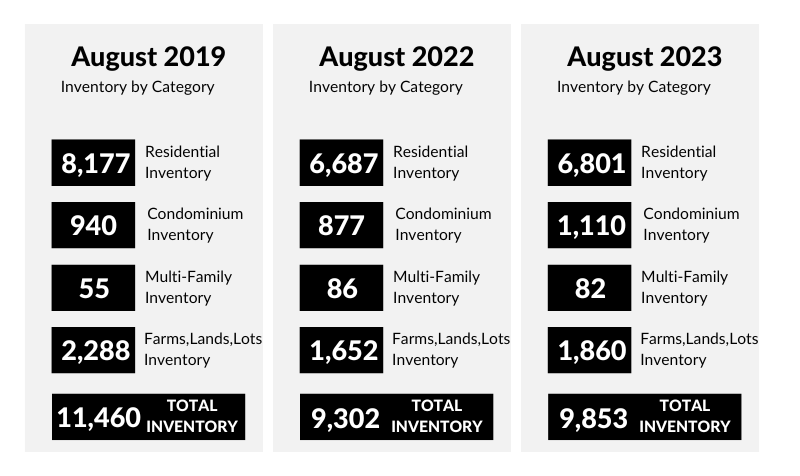

Source: Greater Nashville REALTORS

We know, we know—you love your house. The kitchen is the perfect size, your weekly summer barbecues give your neighbors patio envy, and your ’70s-style conversation pit is totally coming back into vogue—as you knew it would.

You’ve seen the comps for your neighborhood, but you just know your home is worth more, so you’re going to list it at a higher price.

This is one of a few reasons why sellers overprice their home, and none of them is smart. If you price your home too high, it’ll take longer to sell, raising doubts in buyers’ minds about whether there’s something wrong with it, and you’ll probably have to drop the price eventually anyway. So don’t fall for any of these five common justifications sellers use to inflate the price of their beloved property.

The reason that interiors are often painted white or neutral colors before a sale is that that allows potential buyers to envision what colors would make it their home. Your quirky or colorful touches might not be for everyone, and can actually devalue your house.

Alexandra Axsen, owner and managing broker of Lake Okanagan Realty in British Columbia, Canada, listed a home whose bathrooms were all sorts of strange colors—olive-green toilets, a purple bathtub, and a pink sink. When Axsen recommended to the seller a price that factored in the cost of necessary updates, things got a little heated.

“He got very upset and argued with me that his colorful fixtures added value, because people are tired of the all-white, stale hospital look,” Axsen explains.

So they tried the seller’s way first, listing it for his desired price. It didn’t sell, and buyers gave feedback that the home was overpriced. After weeks on the market, the seller finally agreed to lower the price. It sold within a month.

Comps (or comparable market analysis) are valuable reference points that allow you to compare your home to similar nearby homes in order to price it right. But some sellers place too much value on ultimately negligible differences between their home and the comps.

Bruce Ailion, a real estate agent in Atlanta, lists a few he’s heard: “My home has a 60-gallon hot water heater; every other home has 40. My deck is 60 feet larger. My den has real barn wood paneling.”

Small features like this might be worth pointing out to potential buyers, but they’re not going to make or break a deal—and trying to price your home based on the size of your deck is a setup for disappointment. Plus, you might not see the flaws in your home—your deck might be big, but it might also need work.

“By nature, we see life through rose-colored glasses,” Ailion says. “Sadly, it can cost us significantly when it comes to selling our home.”

To be safe. ask your agent for their opinion on comps in your area. You might be surprised by what they say. (Don’t have your agent yet? Here’s how to find a real estate agent in your area.)

A house is an investment, and everyone wants a return on their investment. Couple that with emotional attachment, and you’re primed to mark up your home’s value.

“Sellers think that their house is worth what they want or need to sell it for, but the harsh reality is that a home is worth whatever a buyer is ready, willing, and able to pay for it,” says Will Featherstone, a real estate agent in Baltimore, MD.

Even in a seller’s market, there’s no guarantee that you’ll make money on your house. And just because you need $450,000 to buy that house on Greener Pastures Lane doesn’t mean you can sell your house for the same amount.

Speaking of emotional attachments, if you built your home yourself, you might have some serious issues with overpricing your property.

Case in point: Ariel Dagan, an associate broker in New York City, co-listed a property for a woman who priced a townhouse she built herself at $18.5 million. Dagan’s team tried to get the woman to lower her price, but she was adamant about sticking with the high price tag and ultimately dropped Dagan and his team from the property.

“Shortly after we were dropped from the listing, the price dropped from $18.5 million to $16.9 million,” Dagan says. “Eight months later, the listing sold for $15.5 million—or 19.35% less than the original asking price.”

Ouch.

So, why does that happen? Dagan calls it the “Ikea effect.”

“Most people who buy furniture from Ikea and assemble it themselves think it’s more valuable than it really is, because they built it,” he explains. “Same thing happens in today’s real estate market.”

Perhaps the most common reason people overprice their home is because they’re looking to negotiate.

On paper, it sounds like something you’d see on “Pawn Stars.” You offer up a vintage silver tea set at an inflated price. Rick Harrison offers you 25% of that, but he eventually goes up to 30%. OK, maybe “Pawn Stars” is a bad example, but you get the idea: You price your house 10% higher, fully expecting a buyer to try to lowball you, netting you the price you wanted all along while the buyer walks away thinking he got a bargain.

It doesn’t work like that in real estate.

“It’s much better to price it right and create such interest and demand where buyers are chasing you, versus you chasing the market backward [and] searching for the demand,” Featherstone explains.

So don’t be afraid to price your home fairly, or even underprice it—which is likely to attract buyers and boost the price to where it should be.

“Everything sells when it’s priced right,” Featherstone says.

Finding home loans with bad credit isn’t for the faint of heart—or at least not something you should do without some serious homework. But there’s good news if you’re wondering how to buy a house with bad credit: It can be done!

A good credit score typically means you’ll get a great mortgage. A bad credit score means you’re in trouble, but you shouldn’t just throw in the towel. From low credit score mortgages to cash options to down payment strategies, this crash course explains how to buy a home with bad credit. Yes, it can be done.

First things first: While you may have a vague sense your credit score is bad, that’s not enough. How bad is it, really?

Ideally, you should check your credit report long before meeting with a mortgage lender. Your credit score is based on the information that appears on this report, and you’re entitled to a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com.

Credit scores, also called FICO scores, range from 300 (awful) to 850 (perfection).

If your credit score is 750 or higher, “you’re in the top tier” and positioned for the best interest rates and the most attractive loan terms for home buying, says Todd Sheinin, mortgage lender and chief operating officer at New America Financial in Gaithersburg, MD.

A good credit score is from 700 to 749. If you fall below that range, lenders will start to question whether you’re a risky investment as a potential borrower.

“If your credit stinks, you’re at an immediate disadvantage and may have trouble qualifying for a home loan,” says Richard Redmond, a mortgage broker at All California Mortgage in Larkspur and author of “Mortgages: The Insider’s Guide.”

So, what next?

If your credit rating is subpar, that’s no reason to beat yourself up (at least not immediately), because you may not even be to blame for all of those blemishes.

Creditors frequently make mistakes when reporting consumer slip-ups. In fact, 1 in 4 Americans finds errors on credit reports, according to a 2013 Federal Trade Commission survey. So make sure to scour your credit report for slip-ups that aren’t your own. From there, you’ll need to contact the organizations that provided the erroneous info (e.g., a bank or medical provider) and have them update it. Once that’s done, your credit score will rise accordingly on your credit report.

As for any mistakes that are your fault? If they’re one-time mistakes, it never hurts to call and ask that they get removed from your record.

The only fix for major mistakes (darn chronic credit card debt), however, is time. Banish bad credit by making payments by their due date (late payments truly are the devil for hopeful home buyers), and you will gradually see your credit score rise. Just don’t expect to rewrite your credit history overnight. You have to prove to lenders that you’re up to the task of making those mortgage payments on time—all while saving for a down payment, of course. Nobody said this would be easy!

Depending on your credit score, you might still qualify for low credit score mortgage options—but you should expect to pay a higher interest rate, says Sheinin. Getting a mortgage with a higher rate means you’ll pay your lender more money in interest over time, of course, but it at least enables you to join the home-buying club.

With interest rates still historically low (check yours here), it could make sense to buy now and take the higher rate.

A Federal Housing Administration loan is one option for prospective home buyers with poor credit, as the FHA typically offers these mortgages for less-than-perfect credit scores and first-time home buyers. The FHA requires a minimum 580 credit score (and other requirements) to qualify, but FHA loans also enable you to make a down payment as low as 3.5%.

The big drawback? Because the federal government insures these low credit score home loans, you’ll pay a mortgage insurance premium, which is currently assessed at 1.75% of the base FHA loan amount. However, depending on your actual credit score, certain conventional loans may still be available to home buyers with low credit, and these loans may require a slightly smaller down payment than the FHA loan minimum. Be sure to do your homework when exploring the FHA option.

If you have poor credit but a lot of cash saved up, some mortgage lenders might be willing to approve you for a home loan if you make a larger down payment.

“The more you put down, the more you minimize the risk to the lender,” says Sheinin.

So, by increasing your down payment to 25% or 30% on a conventional loan—instead of the standard 20%—you’ll strengthen your mortgage application, making yourself far more attractive to a lender. Just remember that your bad credit score can still negatively affect your mortgage loan’s interest rate.

Still, though, the chance to own your own home may outweigh those downsides any day. So if you’re convinced your credit history is sure to dash your home-buying dreams, chin up! Put in the work to overcome your bad credit—develop a healthier relationship with credit cards, work with a knowledgeable lender, and explore all of your mortgage options.

By Daniel Bortz

When you buy or sell a home, you get used to hearing words you’ve never heard before. The mortgage lenders and insurance agents who help you through the process will throw around so much real estate jargon, somewhere along the way you might wish you had brought a dictionary—or maybe a translator.

Two rather vague but very important terms for buyer and seller alike are “earnest money deposit” and “down payment.” Both have to do with cold, hard cash, but what’s the difference? Here’s your cheat sheet on earnest money deposit vs. down payment.

Earnest money—also known as an escrow deposit—is a dollar amount buyers put into an escrow account after a seller accepts their offer. Buyers do this to show the seller that they’re entering a real estate transaction in good faith, says Tania Matthews, an agent with Keller Williams Classic III Realty in Central Florida.

Another way to think of earnest money is as a good-faith deposit that will compensate the seller for liquidated damages if the buyer breaches the contract and fails to close.

Earnest money deposits usually range from 1% to 2% of the purchase price of a home—depending on your state and the current real estate market—but can go as high as 10%. If a home sales price is $300,000, a 1% earnest money deposit would be $3,000.

The buyer’s financing can also dictate the amount of an earnest money check. For example, if a buyer makes a cash offer, the seller may request more earnest money to show a true “buy-in” from the purchaser, says Matthews. In that instance, the seller of a $300,000 home might want a 3% deposit (or $9,000) versus the 1% deposit for an offer financed through a mortgage.

In any case, the seller can either accept, reject, or negotiate the buyer’s suggested earnest money amount, says Bruce Ailion, a Realtor® with Re/Max brokerage in Atlanta.

Earnest money deposits are delivered when the sales contract or purchase agreement is first signed. They are often in the form of the buyer’s personal check.

The check is held by the buyer’s agent, title company, or other third party (but never given directly to the seller) and is sometimes never even cashed, says Brian Davis, co-founder of SparkRental.com.

If the check is cashed, the funds are held in an escrow deposit account. The money will be shown as a credit to the buyer at closing and will offset part of the down payment amount or closing costs.

So here’s the real crux of the matter: If a prospective buyer backs out of the deal, the seller might be able to keep the earnest money deposit.

Matthews advises sellers to comb through the contract to see if they can take legal action. But keep in mind that if the buyers back out for any reason allowed by the contract or purchase agreement, they are legally entitled to get their earnest money back.

A down payment is an amount of money a home buyer pays directly to a seller. Despite a common misconception, it is not paid to a lender. The rest of the home’s purchase price comes from the mortgage.

The money you put down can come from the buyer’s personal savings, the profit from the sale of a previous home, or a gift from a family member or benefactor.

Down payments are usually made in the form of a cashier’s check and are brought to the closing of a home sale or wired directly from the buyer’s bank.

The exact amount of a down payment is often determined by the lender in relation to the overall loan amount. The minimum down payment required by mortgage lenders is 3% of the house’s price, and a 20% down payment is recommended by real estate agents.

Your purchase contract offer generally states how much you intend to put down, and a seller may be more likely to accept your offer if you are putting more money down.

But that’s not to say you have to put down 20%. After all, that’s a large chunk of change to have on hand, especially for first-time home buyers.

Be aware that the down payment is not all you need to buy a house. You also need to budget for closing costs, appraisals, and other expenses when you purchase real estate.

For decades, a 20% down payment was considered the magic number you needed to be able to buy. It’s an ideal amount, but for many people it’s not realistic. In fact, many financing solutions exist, so you can consider that myth busted.

“Putting [down] less than 20% is OK with most banks,” Christopher Pepe, president of Pepe Real Estate, in Brooklyn, NY, told U.S. News & World Report.

Of you’re putting down less than 20%, however, there’s a catch. You will probably have to also pay for mortgage insurance, an extra monthly fee to mitigate the risk that you might default on your loan. And mortgage insurance can be pricey—about 1% of your whole loan, or $1,000 per year per $100,000.

Still, nothing compares to the feeling of owning your own home, so if you have your heart set on buying, there are options out there to help you achieve your dream of homeownership.

Getting a mortgage, paying your mortgage, refinancing your mortgage: These are all major undertakings, but during a pandemic, all of it becomes more complicated. Sometimes a lot more complicated.

But make no mistake, home buyers are still taking out and paying down mortgages during the current global health crisis. There have, in fact, been some silver linings amid the economic uncertainty—hello, record-low interest rates—but also plenty of changes to keep up with. Mortgage lending looks much different now than at the start of the year.

First, the good news about mortgage interest rates: “Rates have been very low in recent weeks, and have come back down to their absolute lowest levels in a long time,” says Yuri Umanski, senior mortgage consultant at Premia Relocation Mortgage in Troy, MI.

That means this could be a great time to take out a mortgage and lock in a low rate. But getting a mortgage is more difficult during a pandemic.

“Across the industry, underwriting a mortgage has become an even more complex process,” says Steve Kaminski, head of U.S. residential lending at TD Bank. “Many of the third-party partners that lenders rely on—county offices, appraisal firms, and title companies—have closed or taken steps to mitigate their exposure to COVID-19.”

Even if you can file your mortgage application online, Kaminski says many steps in the process traditionally happen in person, like getting notarization, conducting a home appraisal, and signing closing documents.

As social distancing makes these steps more difficult, you might have to settle for a “drive-by appraisal” instead of a thorough, more traditional appraisal inside the home.

“And curbside closings with masks and gloves started to pop up all over the country,” Umanski adds.

If you’ve lost your job or been furloughed, you might not be able to buy your dream house (or any house) right now.

“Whether you are buying a home or refinancing your current mortgage, you must be employed and on the job,” says Tim Ross, CEO of Ross Mortgage Corp. in Troy, MI. “If someone has a loan in process and becomes unemployed, their mortgage closing would have to wait until they have returned to work and received their first paycheck.”

Lenders are also taking extra steps to verify each borrower’s employment status, which means more red tape before you can get a loan.

Normally, lenders run two or three employment verifications before approving a new loan or refinancing, but “I am now seeing employment verification needed seven to 10 times—sometimes even every three days,” says Tiffany Wolf, regional director and senior loan officer at Cabrillo Mortgage in Palm Springs, CA. “Today’s borrowers need to be patient and readily available with additional documents during this difficult and uncharted time in history.”

Economic uncertainty means lenders are just as nervous as borrowers, and some lenders are raising their requirements for borrowers’ credit scores.

“Many lenders who were previously able to approve FHA loans with credit scores as low as 580 are now requiring at least a 620 score to qualify,” says Randall Yates, founder and CEO of The Lenders Network.

Even if you aren’t in the market for a new home today, now is a good time to work on improving your credit score if you plan to buy in the future.

“These changes are temporary, but I would expect them to stay in place until the entire country is opened back up and the unemployment numbers drop considerably,” Yates says.

The CARES (Coronavirus Aid, Relief, and Economic Security) Act requires loan servicers to provide forbearance (aka deferment) to homeowners with federally backed mortgages. That means if you’ve lost your job and are struggling to make your mortgage payments, you could go months without owing a payment. But forbearance isn’t a given, and it isn’t always all it’s cracked up to be.

“The CARES Act is not designed to create a freedom from the obligation, and the forbearance is not forgiveness,” Ross says. “Missed payments will have to be made up.”

You’ll still be on the hook for the payments you missed after your forbearance period ends, so if you can afford to keep paying your mortgage now, you should.

To determine if you’re eligible for forbearance, call your loan servicer—don’t just stop making payments.

If your deferment period is ending and you’re still unable to make payments, you can request delaying payments for additional months, says Mark O’ Donovan, CEO of Chase Home Lending at JPMorgan Chase.

After you resume making your payments, you may be able to defer your missed payments to the end of your mortgage, O’Donovan says. Check with your loan servicer to be sure.

Current homeowners might be eager to refinance and score a lower interest rate. It’s not a bad idea, but it’s not the best move for everyone.

“Homeowners should consider how long they expect to reside in their home,” Kaminski says. “They should also account for closing costs such as appraisal and title insurance policy fees, which vary by lender and market.”

If you plan to stay in your house for only the next two years, for example, refinancing might not be worth it—hefty closing costs could offset the savings you would gain from a lower interest rate.

“It’s also important to remember that refinancing is essentially underwriting a brand-new mortgage, so lenders will conduct income verification and may require the similar documentation as the first time around,” Kaminski adds.

Right now, homeowners can also score low rates on a home equity line of credit, or HELOC, to finance major home improvements like a new roof or addition.

“This may be a great time to take out a home equity line to consolidate debt,” Umanski says. “This process will help reduce the total obligations on a monthly basis and allow for the balance to be refinanced into a much lower rate.”

Just be careful not to overimprove your home at a time when the economy and the housing market are both in flux.